I fell in love the first time. I’m walking the next time. – A.W.

Heard the above quote on Monday and I was like “Yes”. That’s what I’ve been trying to say. So, here’s the background…

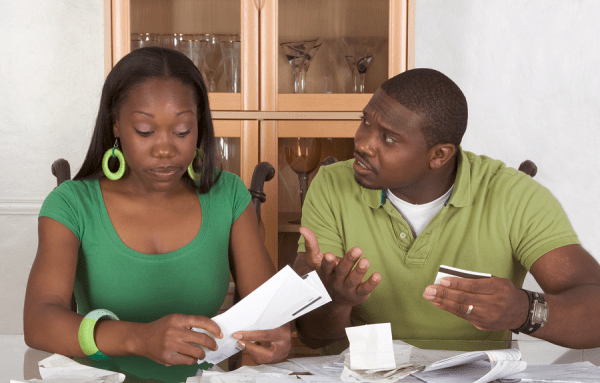

Mr. K and I were talking last week about what I call financial intimacy. I was stressing the importance of financial intimacy when he was discussing the issues in his first marriage. I explained that we had similar stories and that is why I believe in financial intimacy. I explained the concept to him.

Financial intimacy occurs when you and your partner have reached a point in your relationship where you decide to take it to the next level. Whatever that level may be for you. You sit down and provide your full financial picture: i.e. current credit reports, any loans you owe (mortgage, car, student), credit cards, etc. You produce a full financial picture with your partner to share before you take that next step. In my case, it would be engagement, because I’m not shacking up. (Thankfully, he doesn’t either)

What I’m saying is that before you get engaged you need to be intimate financially with each other. You should make sure that you and your partner are aware of the back story before getting engaged. Don’t waste time or money on an engagement ring if you don’t know everything about your partner. It could make for a costly situation.

Call it years of knowledge, or trial by fire, but many people who’ve gone through a marriage and a divorce that cost them financially will agree that you want to walk into any other situation with your eyes wide open. Not falling with your eyes wide shut.

Can you imagine marrying your soul mate only to find out that they are $250,000 in debt? Nope. But, it is real. It happens all the time. But, let me tell you one of the top reasons for divorce….money.

Yep, you know it. Why? Because before we get engaged, we don’t do pre-engagement counseling to determine whether or not we are compatible. It’s counseling before you get engaged. I heard this from a classmate who did it and started researching it. I was like…Yep! This is what everyone needs to do.

I wish I had known about it before I took the plunge. Heck, I’m sure he wished he knew about it too. Once we got engaged and the ring sat on my finger, it seemed that problems were not always handled effectively. One of us was compromising to the point we were dismissing potential landmines so that we could get married. It was about the wedding and getting through to that day so we could live blissfully ever after.

That didn’t work. I don’t remember the financial piece in our pre-marital counseling, but I’m telling you that it in no way prepared us for living, working and paying bills together. We had one philosophy…separate accounts. We tried the first year of marriage to have joint accounts but we had different philosophies on spending that contributed to the stress in our relationship. We loved each other so we didn’t want to argue over money. We thought by keeping separate accounts we could live in bliss. However, after year 10 he wanted to try joint accounts again. I was determined not too. Too many issues already. It became worse.

I’ve learned some things since I last said I do and that is the importance of financial intimacy. No secrets. No hesitation. No regrets. No entering into a situation where I wish I had been prepared. I don’t want a debt that WE didn’t create. You can love all you want with your heart, but you don’t want to pay in the end with your pockets. It can cause resentment.

Until next time!

This is great advice. Realizing your partner has $100k debt is akin to finding out he/she has a child you don’t know about.

LikeLiked by 1 person

I agree, this is really good advice! I imagine it can be a difficult conversation to have, but a very important one. I think people often believe that ‘love conquers all’ and that money issues will sort themselves out. Not true!

LikeLiked by 1 person

I know right? I used to think that, but after my marriage, I know better. You have to go in with your eyes wide open. It doesn’t mean that you don’t love the person.

LikeLiked by 1 person

Great tips! I agree with you 100%, financial intimacy is a must.

LikeLike

This is really a great article. I find that financial intimacy has brought my husband and I closer, and find that it has helped us to get on the same page as to mutual goals. Really excellent points in here.

LikeLiked by 1 person

Thank you. I definitely will require it in my next serious relationship. I didn’t the first time. I was young, but divorce will prepare you in the end. Thanks for reading.

LikeLike

Love your post… thanks for sharing with #Alittlebitofeverything

LikeLiked by 1 person

Reblogged this on A Perfectly Flawed Ruby.

LikeLiked by 1 person

Thank you for the reblog.

LikeLike